REDUCE YOUR RATE:

We can usually reduce your interest rate and payment with a low rate Credit Union vehicle loan.

Have a high rate vehicle loan elsewhere? Refinance with LMFCU and get a $100 cash bonus!

LMFCU will pay off your existing loan and will handle the updating of the vehicle title.

Minimum loan of $15,000 required to get the cash bonus

When you finance a vehicle purchase with LMFCU or refinance a loan currently elsewhere with LMFCU you can delay your first payment for up to 60-days*.

Purchase and refinance loans are available.

Loan Interest Saved For

Each 1% Reduction in Rate

|

Loan Amount |

5 Year |

6 Year |

|

$25,000 |

$682 |

$828 |

|

$40,000 |

$1,091 |

$1,325 |

|

$60,000 |

$1,660 |

$2,020 |

Low rates available on both new and used vehicle loans.

-

Rates as low as 3.99% APR* for 2024, 2025 & 2026 models

-

Rates as low as 4.49% APR* for 2020 to 2023 models

-

Rates as low as 5.24% APR* for 2017 to 2019 models

-

100% financing, terms up to 7-years available*

-

Finance back through the 2013 model year*

Skip-A-Payment

Need to take a break from payments? You can skip a payment once a year in the future. Restrictions apply.

Guaranteed Auto Protection

GAP eliminates the out-of-pocket expenses you would incur to payoff your loan should your vehicle be stolen or totaled. Our GAP fee is only $499. For those using your vehicle for work or other purposes such as food delivery or Uber or Lyft, the GAP plan fee is $699.

Extended Warranties

Our extended warranty costs are typically lower than the dealers and typically provide the same or better coverage! There are no deductibles and you may take your vehicle to any licensed mechanic.

Current Loan Rates

Start the Year with Lower Car Payments

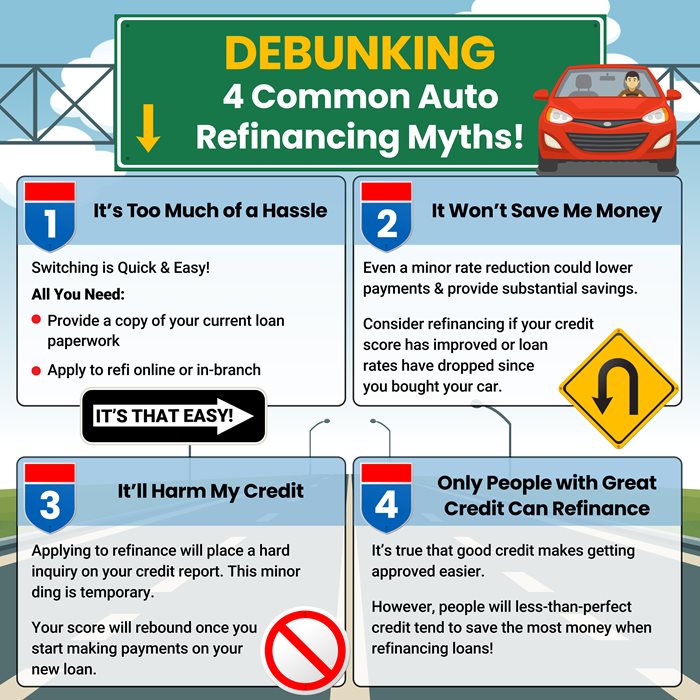

Information About Refinancing Your Loan

LMFCU Auto Buying Center