Vehicle Extended Warranties

OUR EXTENDED WARRANTY COSTS ARE TYPICALLY LOWER THAN THE DEALERS AND PROVIDE THE SAME OR BETTER COVERAGE!

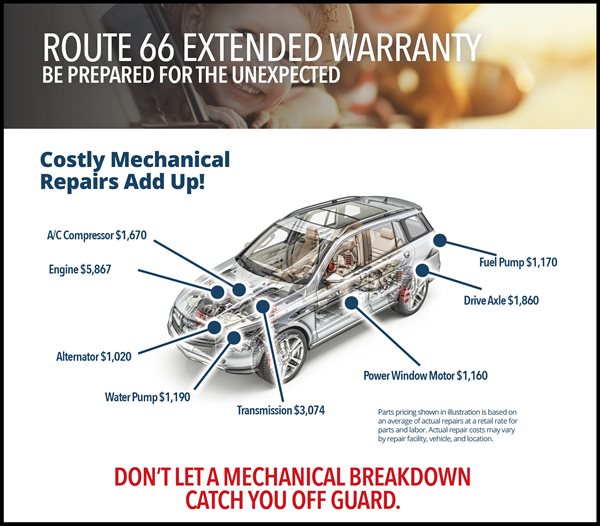

Did you know that one in three vehicles has a mechanical failure in a given year? We are pleased to offer affordable Mechanical Breakdown Protection coverage through Route 66. Plans for autos and trucks start around $1,450. There are different plans and different levels of coverage. Warranties are available even if your loan isn't with the Credit Union. Click here for detailed auto and truck extended warranty coverage information. Click here for detailed motorcycle and ATV extended warranty coverage information. Contact a Loan Specialist for details.

-

$0 Deductible, and you may take your vehicle to any certified mechanic

-

Nationwide Coverage

-

Includes 24/7/365 Emergency Roadside Service

-

Our “Easy Street” Factory type extended warranty coverage is available on 2020 and newer models with 100,000 or less miles.

-

Our “Main Street” Major Component Coverage is available on most 2016 or newer models with up to 140,000 miles (Drivetrain coverage is also available on older vehicles no restrictions on age or mileage) Optional electronics coverage is available.

-

30 Day Money-Back Guarantee

-

Transferable

-

Covers up to $100 for each emergency battery replacement (Easy Street & Main Street coverage only)

For 2016 and newer models, electronics coverage includes:

-

LCD screens

-

DVD Players

-

Satellite & MP3 Radios

-

Backup/Reverse Sensors

-

Rearview Backup Camera

-

Side & Rearview Mirror Cameras

-

Drivers Assist Systems

The Emergency Roadside Service, benefit up to $100, Includes:

-

Towing

-

Flat Tire Assistance

-

Battery Jump Starting

-

Lock-Out Service

-

Fuel & Fluid Delivery and Minor Adjustments

HOW TO CLAIM

Simply contact or have a representative of the repair facility contact the Administrator before ANY work is performed by calling the Claims Department at 1-800-808-0828 or by emailing claims@route66warranty.com. The following information will be required before authorization for repairs:

(1) AGREEMENT NUMBER (2) AGREEMENT HOLDER’S NAME (3) CURRENT MILEAGE (4) MECHANICAL COMPLAINT (5) ITEMIZED ESTIMATE.

IMPORTANT: You will be required under this Service Agreement to authorize the repair facility to disassemble the component(s) for inspection before repair or replacement. You will be required to pay the cost of disassembling if the Mechanical Breakdown is not covered by this Service Agreement.

Upon diagnosis and determination of covered items, and subject to the terms and conditions of this Agreement, the Administrator will issue an AUTHORIZATION NUMBER.

IMPORTANT: The authorization number MUST appear on all repair bills.

Failure to obtain authorization PRIOR TO REPAIRS will result in non-payment of claim. FRAUDULENT USE or MISUSE of this Agreement will result in non-payment and cancellation. THE ADMINISTRATOR RESERVES THE RIGHT TO INSPECT ALL REPAIRS PRIOR TO OR AFTER REPAIRS ARE PERFORMED.

Have an existing warranty with another provider?

To request a warranty quote contact us with the vehicle information, current mileage and VIN at loans@lmfcu.org or by telephone at (800) 410-0501.

Guaranteed Auto Protection (GAP)

Now you can protect your vehicle investment with Guaranteed Auto Protection (GAP). GAP offers protection in the event that your vehicle is stolen or damaged beyond repair (deemed a Total Loss) and is available for borrowers that finance their vehicle(s) with a loan from LM Federal Credit Union.

Here's how GAP works. Let's say after one year, the vehicle you purchased for $25,000 is now valued at just $16,000, but you still owe $20,000 when it is involved in an accident and your insurance carrier deems it a Total Loss. Most insurance policies will only reimburse you for the “Actual Cash Value (ACV)” of your vehicle, $16,000 in this case, leaving you with a large loan balance and no vehicle. Here is an example of what you would owe without GAP;

|

Amount you owe on your auto loan |

= $20,000 |

|

Your Insurance Company “ACV” |

= $16,000 |

|

Your Insurance Deductible |

= $500 |

|

|

-------------- |

|

Amount Paid by your Insurance |

= $15,500 |

|

Remaining loan balance or GAP |

= $4,500 |

A $1,000 bonus payment is also provided if you finance your replacement vehicle with LMFCU (restrictions apply).

What's the cost for this valuable protection? Our GAP is just $499 for most types of collateral like new and used cars, trucks and motorcycles. Dealers charge as much as $1,295 for the same GAP protection plans. GAP is also available on RVs, boats, and travel trailers, but the fee is determined by the Amount Financed and loan term. For those using your vehicle for work or other purposes such as food delivery or Uber or Lyft, the GAP plan fee is $699. This is a small price to pay for real peace of mind!

GAP...For Affordable Peace of Mind**. For more information, please contact the Credit Union at (800) 410-0501 or e-mail your questions and we'll reply as soon as possible.

**This is general information only. Please refer to your actual GAP Waiver Addendum (GAP) for terms, conditions, coverage, limitations, and restrictions. GAP is not an insurance policy and does not replace or eliminate the need for vehicle insurance coverage. GAP is designed to “help” reduce the difference between your primary carrier insurance settlement and the loan balance at the date of loss. However, there are exclusions and limitations for items like delinquent payments, late charges, refundable items and financing more than the allowable Loan to Value (LTV%) limit that could leave you responsible for a loan balance after the GAP benefit is applied to your loan. You may cancel GAP during the first 60 Days and receive a full refund of any fee paid. GAP is non-refundable in most states after the first 60 Days.

Is Loan Credit Insurance Right For You?

Protect your payment and credit with low-cost credit insurance through TruStage™. Credit Life or Accident and Sickness Insurance that will repay your loan if you become disabled due to a covered illness or accident or in the event of your death. There are no medical questions or forms to complete. For additional information, speak to one of our Loan Specialists by calling (800) 410-0501 (option 2) or e-mail loans@lmfcu.org.