Your financial advisor plays a significant role in your current and future finances. Even minor suggestions today can have a tremendous impact down the road. So, you want to ensure your advisor is actively working in your best interest.

While it might seem that financial advisors are all relatively the same, they differ in skillsets, experience levels, and even the services they are licensed to offer. How can you tell if your advisor is a good fit for you?

In this article, we’ll dive into the role your financial advisor plays, questions you should ask yourself about their performance, and ways to strengthen your financial position.

The Importance of a Financial Advisor

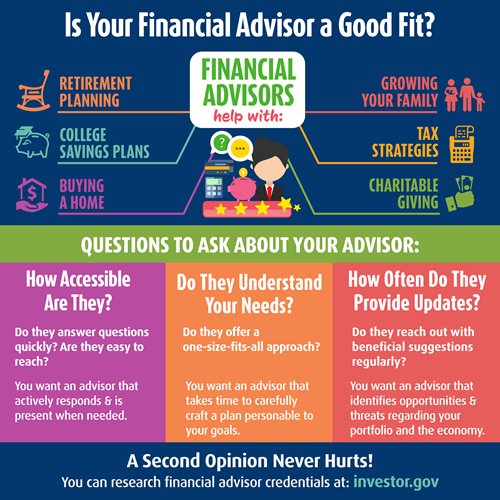

When you hear the term “financial advisor,” you likely think about retirement. Depending on your age, retirement can often feel like a lifetime away. This scenario causes many younger people to put finding a financial advisor on the back burner until later in life. However, the role of a financial advisor extends far beyond retirement planning. Their input can directly impact your shorter-term goals, like buying a new car or starting a family.

Here are common scenarios where a financial advisor’s guidance can be crucial:

-

Buying a home

-

Saving for your children’s college expenses

-

Paying for a wedding or other milestone event

-

Creating a healthcare plan

-

Managing wealth and investments

-

Tax planning and strategies

-

Estate planning

-

Insurance coverage

-

Charitable giving

Questions to Ask About Your Financial Advisor

Many people choose their financial advisor based on recommendations from family members or friends. Perhaps your employer offers retirement services, or maybe you heard an advertisement on the radio or TV. How you found your advisor isn’t important. Deciding whether they are the right fit for you is key.

Here are a few questions you can ask yourself when determining if your financial advisor has your best interests at heart:

Can you reach your advisor easily when you need to? Do they respond to you in a timely manner? Or are you often left reaching out with no response? If you have a hard time getting in touch with your financial advisor, it’s probably time to start looking for someone new.

-

Do They Understand Your Needs?

Many financial advisors try to offer a cookie-cutter approach. They have a plan that has worked well before, so they prescribe it to most clients. Whether that strategy aligns with your unique needs and goals isn’t a top concern. Rather than being forced into a one-size-fits-all solution, you want an advisor who cares about your short-, medium-, and long-term goals. They should be willing to take the time to devise a carefully crafted plan to help you accomplish all your objectives.

-

How Often Do They Provide Updates?

Do you hear from your advisor regularly? Do they reach out to offer suggestions pertaining to the economy and how it affects your portfolio? While a hands-off approach might be the right fit for some clients, many prefer a more hands-on experience. If you want an advisor who keeps in contact consistently, don’t be afraid to screen potential new advisors so you can secure the right one for you.

-

Are Their Suggestions Relevant?

Many financial advisors maintain a roster of dozens or even hundreds of clients at a time. Depending on your advisor's client load, they may not be able to offer the personalized approach you deserve. Your plan may receive little to no attention if your advisor is more worried about the number of clients they manage rather than how well they manage them.

You can tell if your account ranks highly on your advisor’s priority list by the frequency and quality of updates they provide. Do you get personable and actionable updates relevant to your specific portfolio? Or do you receive generic updates for everyone – like an email blast sent to their entire client list?

-

Is Their Advice Just Bad?

Unfortunately, some advisors are only looking out for themselves. They sell commission-based products that may not always be in your best interest. They may push a product that’s not a good fit for you solely to earn the commission. Their focus is on padding their wallet – not yours.

Other advisors may overlook crucial planning components, such as future tax implications, simply because that’s not their area of expertise, and they haven’t fully familiarized themselves with the guidelines. You want a competent advisor who can provide you with well-rounded advice.

Can you Switch Financial Advisors?

If you feel like your current financial advisor doesn’t have your best interest at heart or otherwise isn’t a good fit for you, don’t be afraid to seek out someone new who will be a better match for you. It never hurts to get a second opinion! Plus, you might not even realize your advisor doesn’t quite fit for you until you seek out other options.

If you’re on the fence about your current advisor, take these steps:

-

Check Their Credentials: You can research the credentials and licenses of any financial advisor within the United States using the U.S. Securities and Exchange Commission (SEC) database at www.investor.gov.

-

Review Any Agreements: Check to see if you have an agreement or contract with your advisor. Your actions might be limited per this agreement. Depending on the limitations outlined, you may need to wait until the agreement expires to find a new advisor. If you don’t have any agreements or constraints, you can switch whenever you like.

-

Obtain Copies of Records: Ask for copies of any financial statements or other records on file with your current advisor. Obtain statements of your current portfolio, including where your funds are invested, how your accounts are set up, and any other important information.

-

Seek a Second Opinion: Obtain recommendations for another advisor from family, friends, professional networks, online forums, etc. Research the firm(s) or individual(s) at www.investor.gov. Once you have your short list of potential new advisors, schedule appointments for initial consultations. Ask questions, state your goals, and ask them about their process. Make sure you discuss communication preferences, how they provide suggestions for your accounts and any other qualities you want to ensure are aligned with your expectations.

We’re Here to Help!

Finding the right financial advisor for you can be a night and day difference. Everything from planning to start a family, buying a home, saving for retirement, and financing milestones in between just falls into place.

If you’re looking for a new financial advisor, we encourage you to seek a second opinion with our Financial Planning Services division. If you’re looking to partner with an advisor for the first time, we’re eager to assist you in finding the right match.

Our team is ready to answer all your questions about retirement planning, 401k rollover assistance, and more. Please stop by the Credit Union or call 410-687-5240 to schedule an appointment today.