The tax filing deadline is fast approaching, which means time is running out to fund an IRA for 2024. If you had earned income last year, you may be able to contribute up to $7,000 for 2024 ($8,000 for those age 50 or older by December 31, 2024) up until your tax return due date, excluding extensions. For most people, that date is Tuesday, April 15, 2025.

You can contribute to a traditional IRA, a Roth IRA, or both. Total contributions cannot exceed the annual limit or 100% of your taxable compensation, whichever is less. You may also be able to contribute to an IRA for your spouse for 2024, even if your spouse had no earned income.

Traditional IRA contributions may be deductible

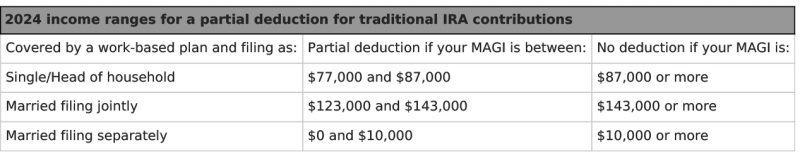

If you and your spouse were not covered by a work-based retirement plan in 2024, your traditional IRA contributions are fully tax deductible. If you were covered by a work-based plan, you can take a full deduction if you're single and had a 2024 modified adjusted gross income (MAGI) of $77,000 or less, or married filing jointly with a 2024 MAGI of $123,000 or less. You may be able to take a partial deduction if your MAGI fell within the following limits.

If you were not covered by a work-based plan but your spouse was, you can take a full deduction if your joint MAGI was $230,000 or less, a partial deduction if your MAGI fell between $230,000 and $240,000, and no deduction if your MAGI was $240,000 or more.

Consider Roth IRAs as an alternative

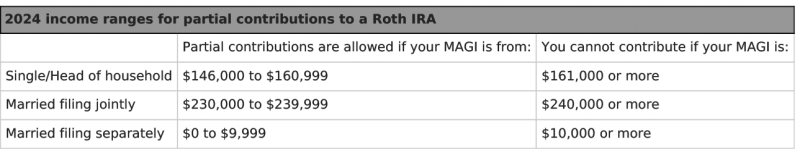

If you can't make a deductible traditional IRA contribution, a Roth IRA may be a more appropriate alternative. Although Roth IRA contributions are not tax-deductible, qualified distributions are tax-free. You can make a full Roth IRA contribution for 2024 if you're single and your MAGI was $146,000 or less, or married filing jointly with a 2024 MAGI of $230,000 or less. Partial contributions may be allowed if your MAGI fell within the following limits.

Tip: If you can't make an annual contribution to a Roth IRA because of the income limits, there is a workaround. You can make a nondeductible contribution to a traditional IRA and then immediately convert that traditional IRA contribution to a Roth IRA. (This is sometimes called a backdoor Roth IRA.) Keep in mind, however, that you'll need to aggregate all traditional IRAs and SEP/SIMPLE IRAs you own — other than IRAs you've inherited — when you calculate the taxable portion of your conversion.

A qualified distribution from a Roth IRA is one made after the account is held for at least five years and the account owner reaches age 59½, becomes disabled, or dies. If you make an initial contribution — no matter how small — to a Roth IRA for 2024 by your tax return due date, and it is your first Roth IRA contribution, your five-year holding period starts on January 1, 2024.