Many students take out federal and/or private student loans to pay for college or graduate school. This article focuses on federal student loans, highlighting current interest rates, borrowing limits, and repayment options. Private loans are typically more costly and provide fewer consumer protections and repayment options than federal student loans.

The basics

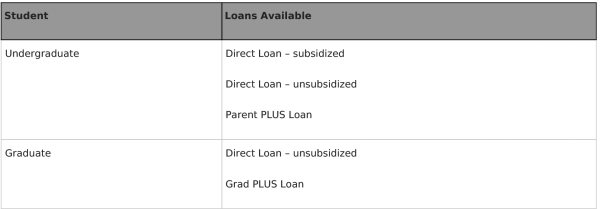

The two main types of federal student loans offered by the U.S. Department of Education are Direct Loans and Direct PLUS Loans.

Direct Loans. There are two types of Direct Loans: subsidized and unsubsidized. Subsidized Direct Loans are available only to undergraduate students attending school at least half time and are based on financial need. Unsubsidized Direct Loans are available to both undergraduate and graduate students and are not based on financial need; any student attending at least half time is eligible. "Subsidized" means the government generally pays the interest that accrues while the student is in school, during the six-month grace period after graduation, and during any deferment or forbearance periods. "Unsubsidized" means the student pays the interest that accrues during these periods.

Both subsidized and unsubsidized Direct Loans have annual borrowing limits. To be considered for either type of Direct Loan, students must fill out the federal government's Free Application for Federal Student Aid form, the FAFSA.

Direct Plus Loans. There are two types of PLUS Loans: Grad PLUS Loans, which are available to graduate and professional students attending at least half time, and Parent PLUS Loans, which are available to parents of dependent undergraduate students attending at least half time. Both types of PLUS Loans require a credit check. In addition, Grad PLUS Loans require students to fill out the FAFSA, while Parent PLUS Loans require both the FAFSA and a separate application.

The following table shows which loans are available to undergraduate and graduate students.

Borrowing limits and interest rates

Direct Loans are the most common federal loan that students use to help pay for college or graduate school. Here are the current borrowing limits:

For dependent undergraduate students, the Direct Loan limits are $5,500 for freshmen (including up to $3,500 subsidized); $6,500 for sophomores (including up to $4,500 subsidized); and $7,500 for juniors and seniors (including up to $5,500 subsidized), with a maximum loan limit of $31,000.

For independent undergraduate students and dependent students whose parents are unable to obtain a PLUS Loan, the Direct Loan limits are $9,500 for freshmen (including up to $3,500 subsidized); $10,500 for sophomores (including up to $4,500 subsidized); and $12,500 for juniors and seniors (including up to $5,500 subsidized), with a maximum loan limit of $57,500.

For graduate students, the Direct Loan limits are $20,500 per year (or $40,500 for certain medical training), with a maximum loan limit of $138,500 (or $224,000 for certain medical training), including undergraduate borrowing.

PLUS Loans have no dollar borrowing limits per year; graduate students and parents are able to borrow up to the full cost of attendance (minus other financial aid received).

The following table shows the interest rate for Direct Loans and Direct PLUS Loans issued July 1, 2024 through June 30, 2025 (the rate is fixed for the life of the loan).

.jpg?width=600&height=144)

Repayment options

One of the main benefits of federal student loans is that the government offers several repayment options.

Standard Repayment Plan. With this original repayment plan, you pay a fixed amount each month over a 10-year term.

Graduated Repayment Plan. The repayment term is still 10 years, but payments start out lower in the early years of the loan and then increase gradually, usually every two years. This plan is for borrowers with relatively low current incomes who expect their incomes to increase in the future. Borrowers electing this payment option will ultimately pay more for their loan compared to the standard plan because of the additional interest that accumulates in the early years of the loan when the outstanding balance is higher.

Extended Repayment Plan. You extend the time you have to repay your loan, up to 25 years. Your fixed monthly payment is lower than it would be under the standard plan, but you'll ultimately pay more for your loan because of the additional interest that will accumulate over the longer repayment period. This plan may be combined with a graduated plan.

Income-Driven Repayment (IDR) Plan. There are several income-driven repayment plans available for Direct Loans and Grad PLUS Loans (but not Parent PLUS Loans), including the newest and most generous Saving on a Valuable Education (SAVE) Plan, which replaces the Revised Pay As You Earn (REPAYE) Plan. With income-driven plans, your monthly loan payment is based on your discretionary income and family size, and loan balances are generally forgiven after a certain number of on-time payments. Visit the Department of Education's website to learn more.

Loan consolidation. This is technically not a repayment option, but it can affect the amount you pay each month. With loan consolidation, several student loans are combined into one loan, sometimes at a lower interest rate, so you can write one check each month. A federal consolidation loan has a fixed interest rate for the life of the loan and is based on the weighted average of the interest rates on the loans being consolidated, rounded up to the nearest one-eighth of 1%. Consolidated loans are generally eligible for any of the repayment plans listed above; however, consolidation loans that include Parent PLUS Loans are not eligible for IBR.

In addition to offering several repayment options, federal student loans offer loan deferments during periods of economic hardship. In this case, Direct Loan, Grad PLUS Loan, and Parent PLUS Loan borrowers can defer their loan payments for up to three years. (However, for unsubsidized Direct Loans, Grad PLUS Loans, and Parent PLUS Loans, interest will continue to accrue.)

What will your monthly payment be?

Before you or your child borrow for college, it's important to know how much you'll need to pay back each month once payments start. The following chart shows monthly repayment amounts for different borrowing totals over 10- and 20- year terms at a 5% interest rate.

.jpg?width=600&height=330)