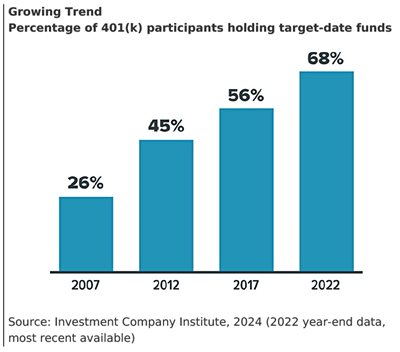

Two out of three 401(k) participants have assets in a target-date fund — an "all-in-one" fund intended in theory to be the holder's only investment (see chart). These funds are often the default option in workplace plans, so you may have a target-date fund without fully understanding what it is, or perhaps without even knowing you own it.

In fact, target-date funds are not as simple as they appear to be. Like all investment options, they have strengths and weaknesses.

Focused on time

Target-date funds offer a professionally managed mix of assets — typically a combination of other funds containing stocks, bonds, and cash alternatives — selected for a specific time horizon.

The target date, usually included in the fund's name, is the approximate date when an investor would begin to withdraw money for retirement (or another purpose, such as paying for college). An investor expecting to retire in 2055, for example, might choose a 2055 fund. As the target date approaches, the fund typically shifts toward a more conservative asset allocation to help preserve the value it may have accumulated and potentially provide income.

One size may not fit all

Target-date funds utilize basic asset allocation principles that are often used to construct more complex portfolios. But the allocation is based solely on the target date and does not take into account the investor's risk tolerance, personal goals, asset levels, sources of income, or any other factors that make an investor unique.

An investor with $200,000 in a target-date fund has the same asset allocation as an investor with $20,000 in the fund. An investor who also has a pension and might be comfortable taking more risk with 401(k) investments is placed in the same risk category as an investor who will depend primarily on savings in the 401(k) account.

Considering this one-size-fits-all approach, target-date funds may be especially appealing to novice investors with relatively low assets or to those who prefer a simple set-and-forget option in their 401(k), IRA, or other investment account. But even if simplicity is the goal, it's important for any investor who keeps assets in a target-date fund to learn more about the specific fund and how it operates.

Glide to or beyond retirement

The transition from more aggressive to more conservative investment allocations is driven by a formula called the glide path, which determines how the asset mix will change over time. The glide path may end at the target date or continue to shift assets beyond the target date, taking the fund into your retirement years.

Funds with the same target date may vary not only in their glide path but also in the underlying asset allocation, investment holdings, turnover rate, fees, and fund performance. Be sure you understand the asset mix of your fund and how it changes over time. It's especially important to closely examine your target-date fund as you approach retirement. You can find detailed information in the prospectus.

Asset allocation is a widely accepted method to help manage investment risk. It does not guarantee a profit or protect against investment loss, and there is no guarantee that you will be prepared for retirement on the target date or that the fund will meet its stated goals. Keep in mind that investing in other securities outside of a target-date fund may change your overall asset allocation. It's generally wise to consider the allocation strategy of your full portfolio.

The principal value of a target-date fund is not guaranteed before, on, or after the target date. The return and principal value of all mutual funds fluctuate with changes in market conditions. Shares, when sold, may be worth more or less than their original cost.

Mutual funds are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.