It’s hard to resist a big banner that says 0% APR. The idea of paying no interest on a new car sounds like a dream come true. After all, anything that saves money must be a good deal, right? Not always.

While 0% financing offers can look great on the surface, they often include conditions that make them less of a bargain than they appear. In many cases, members save more money in the long run by choosing traditional financing, especially through the credit union, where the focus is always on your best financial outcome.

Here’s how these offers really work and what to watch for before signing on the dotted line.

The Cash Rebate Trade-Off

The first catch with most 0% APR promotions is that you must choose between the special rate or a cash rebate on the car’s purchase price. At first glance, 0% interest sounds unbeatable, but the rebate you give up can easily outweigh the savings.

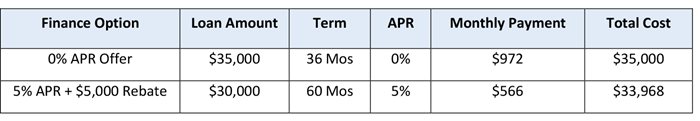

Example:

Imagine you’re buying a car priced at $35,000. The dealership offers:

-

Option A: 0% APR for 36 months

-

Option B: $5,000 rebate (and you finance with the credit union at 5% APR for 60 months)

Here’s how the math breaks down:

Even with interest, the rebate option saves more than $1,000 overall. The “no-interest” offer sounds good, but in many cases, it simply ends up costing more.

Only the Best Credit Qualifies

Here’s another hidden truth: most 0% offers are reserved for “well-qualified buyers.” That typically means a credit score above 740, minimal debt, and a strong payment history.

Even if you qualify, the dealership may still require a larger down payment to secure the offer. If your score is slightly lower, you might be offered a higher “promotional” rate instead - often without realizing how much that difference will add up over time.

Before you get swept up in a 0% deal, check your credit and compare it with your credit union’s pre-approval offer. You may find that your rate is already competitive and comes without hidden conditions.

Higher Monthly Payments & Shorter Terms

Most 0% financing deals also come with shorter repayment terms, usually 24 to 36 months. While that helps to pay off the car faster, it also leads to much higher monthly payments.

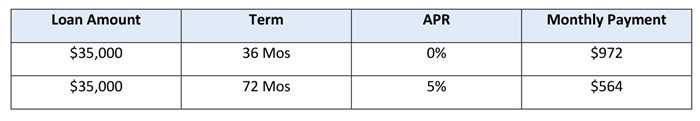

Example:

Imagine you’re buying a car priced at $35,000. You have two financing options:

-

Option A: With the dealership at 0% APR for 36 months

-

Option B: With the credit union at 5% APR for 72 months

Here’s how the monthly payments differ:

That’s a $408 difference in monthly payments. Although the 0% offer avoids interest, it may not fit comfortably within your budget. Add insurance, taxes, and maintenance, and the real cost can feel much higher than expected.

A longer-term credit union loan can provide more flexibility, allowing you to choose a payment that suits your lifestyle and keeps your finances balanced.

Hidden Add-Ons & Markups

Dealerships rarely lose money on 0% loans. Once you agree to finance through them, they often make up the difference through optional add-ons, such as extended warranties, service plans, or dent & scratch protection.

These extras can add thousands of dollars to your loan and are easier to sell when buyers are focused on the excitement of “no interest.” In some cases, the dealer may even increase the car’s price to offset the cost of offering 0% financing.

If you already have credit union financing secured, you can confidently decline these extras or review them with your Credit Union Loan Specialist to discuss the Credit Union’s GAP and Extended Warranty options, which are typically less expensive than the dealer offerings. For example, the Credit Union’s Guaranteed Auto Protection (GAP) plan is only $499!

The Power of Your Pre-Approval

Getting pre-approved through the credit union before visiting a dealership is one of the smartest ways to protect your finances and simplify the car-buying process.

A pre-approval gives you:

-

Clarity: You’ll know exactly how much you can borrow and what your monthly payment will be.

-

Confidence: You can focus on negotiating the vehicle’s price instead of playing dealer financing games.

-

Control: You’ll already know your rate, loan term, and total cost before stepping into the showroom.

Together, these benefits take the stress out of the car-buying process and help you make decisions based on facts - not pressure.

If a dealer pushes you to abandon your credit union’s pre-approval, that’s an immediate warning sign. They may be trying to steer you into buying a more expensive vehicle or a loan that benefits them. Remember, your pre-approval was designed around your goals and budget - not the dealer’s.

Let’s Run the Numbers Together

Unlike dealerships, the credit union’s goal isn’t to sell add-ons or increase profits. It’s to help you make confident, well-informed financial choices that fit your life.

If you’re unsure about whether a dealer’s offer is better than your pre-approval, call us. We’re happy to compare both options and walk through the numbers together. If the dealership truly has a better deal, we’ll let you know. That’s what it means to be part of a not-for-profit financial institution that puts members first.

We’re Here to Help!

A 0% APR deal might sound like the best way to save, but once you look closer, it’s not always the most affordable option. By getting pre-approved with the credit union, you’ll know your real rate, your monthly payment, and your total cost before you ever step onto the lot. It’s a simple way to stay in control of your purchase and protect your budget.

If you want to learn more about auto loan pre-approvals or need help reviewing a dealership offer, we’re ready to help. Please stop by any of our convenient branch locations or call XXX-XXX-XXXX to speak with a member of our lending team today.