Car Buying 101

No one ever said it would be easy to buy your first car, did they? Chances are you've received lots of advice on your way to the dealership - not all of it helpful and much of it conflicting. So, before you take that test drive, there are some things you ought to consider.

Dad may have told you how to get a good deal; and Mom may be more concerned with safety features and gas mileage. But did either of them go over the basic rules of financing your first wheels?

If not, here's the short course in how to do it right:

Think total price rather than monthly payment. If that sounds basic, it really should be. But many people think if they can handle the monthly payment, it really doesn't matter how long it takes to pay it off. Problem is that it does matter. In a worst case scenario, you find yourself owing more than the vehicle is worth. Always look down the road, so to speak, before you agree to a longer term just to lower the monthly payment.

You pay interest every month on the unpaid balance. Stretching out those payments adds dollars to the total price. It's basic math. So, when you compare a Kia to a Chevy, compare features and mileage, warranties and safety features, colors, options and cargo capacity. But always ask about the total price. That's a much more valid way to compare vehicles than choosing between a sunroof and navigation system.

Be clear about how you intend to use your car. Daily commutes of 20 miles a day with an occasional weekend getaway are very different from extended driving that has you on the road for days at a time. If you plan to haul samples, sports equipment or strollers and bicycles, be sure the trunk or cargo space meets your needs. Also, try out the back seat for comfort and ease.

Insurance is vital. Costs can vary substantially from one make and model to another, but your insurance premium is also based on your age and driving record as well as your location. If you don't currently have insurance, compare rates and coverage before you sign a contract to buy. Insurance is one thing you cannot afford to be without, but do take the time to understand what you're really paying for! If you already have insurance, make sure you contact your insurance company to see how much your premiums will change with the new vehicle before you buy.

Know all the upfront costs associated with buying a vehicle. In addition to the down payment, other expenses are due upfront. Tax, title and license are typically rolled into the loan, but they don't have to be. Are you prepared to shell out the cash? There are also ongoing costs when you own a car - yearly inspections and license tags, parking and maintenance. Budget for them.

Finally, get pre-approved by the credit union first. You'll be armed with a powerful negotiating tool if you know your dollar limitation and interest rate. In some ways, buying a car is like playing a game. If you know the rules, you'll be able to strategize effectively and you can win the prize.

Whether you're looking at a new or used vehicle, the basics are the same. Look for value, reliability and affordability as well as the right color!

We’re Here to Help!

When you’re ready to begin looking for your next vehicle, stop by the Credit Union or give us a call at 410-687-5240. We’re ready to help you get pre-approved and lock in a great, low rate.

RETURN TO THE TOP

Dealership Tactics to Avoid

Walking into a car dealership can sometimes feel like diving into shark-infested waters. You never know when a dealer will “bite” with crafty sales tactics that get you to sign on the dotted line. Understanding many of these dealer tricks will help you make prudent and comfortable purchasing decisions the next time you need a new car, truck, minivan or SUV.

Bait-and-Switch Ads

See a particular car on TV or online with an awesome price? By the time you reach the dealer, it’s suddenly gone – but the sales team can point you in the direction of a more expensive alternative. Or perhaps the car’s still there, but the price definitely isn’t the same.

You’ll see this tactic used most often with pre-owned vehicles because the dealership cannot simply “order” another vehicle with those exact same features and miles. Dealers use this scheme to lure you to their dealership and then try to sell you a more expensive vehicle instead.

Additional Extras

Many dealers like to throw in extras like rust protection and warranty extensions. Many of these expensive add-ons are completely unnecessary. Plus, the credit union also offers GAP (Guaranteed Asset Protection) and Extended Warranties that are usually up to 50% LESS than those sold by dealerships!

High-Pressure Sales Tactics

Any salesperson worth their salt knows how to ratchet up the pressure to get customers to buy as soon as possible. The key is to not give in to the pressure. You will always hear that the specific car you’re looking at will not be there tomorrow. It most likely will be. And if it isn’t, the dealership can usually find another one pretty quickly. Don’t be rushed – dealerships use this tactic to confuse you. Buying a vehicle is a big financial decision and shouldn’t be made quickly without serious consideration.

The Old Four-Square Worksheet

Dealers often break this one out to work in a better deal for themselves. With it, the dealership factors in trade-in value, vehicle purchase price, your down payment and monthly payments. Run the numbers yourself before darkening any dealer’s doorstep. If you can, consider selling your old car yourself, as you’re likely to get more for it on the open market than as a trade-in, in most cases. You can also visit www.NADAGuides.com to get your Trade-In’s NADA value.

In addition, with your smartphone, you can download a quick, free Loan Calculator App to help you run the numbers yourself while you’re at the dealership. You’ll be able to calculate how much interest you’ll be paying on the loan and how different loan terms affect your payments.

Dealer Financing

In-house financing often features higher interest rates and hidden fees. You may also be locked in the loan with them; unable to refinance it later on somewhere else should rates decrease. Furthermore, they may include pre-payment penalties that prevent you from paying off the loan early.

When looking to purchase a new vehicle, your first step should always be to obtain a pre-approval from the credit union. A pre-approval means the credit union reviewed your finances with you and approved you to purchase a vehicle at a specific loan amount. This is one of the most powerful tools when it comes to purchasing a vehicle as it shows the dealer you cannot purchase a vehicle over your approved amount.

Oftentimes dealerships will lower the price of a vehicle to match your pre-approved amount. Remember, dealerships want to sell cars; not lose a sale over a few hundred dollars.

It’s important to note that because a pre-approval acts in your favor, crafty salespeople will often try to convince you to finance with the dealership instead. They promise you better financing, but are usually trying to sell you a more expensive vehicle.

We’re Here to Help!

There’s no need to get bitten by shady sales tactics when you’re looking for a brand-new ride. Arming yourself with the above knowledge, in addition to securing a pre-approval with the credit union, goes a long way towards a more pleasant car-buying experience.

If you’re ready to purchase a new vehicle or have questions on the car-buying process, stop by the Credit Union or give us a call at 410-687-5240.

RETURN TO THE TOP

Focus on Price – Not Payments

The time has come! You’ve saved for your down-payment. You’ve triple-checked your finances and know your available monthly budget. You even found the perfect car online. Excitement is in the air, along with that new-car smell. And…you’re walking into a trap!

Salespeople at dealerships are listening for that one vital piece of information…you’re MONTHLY BUDGET. Why? Because with a little creative math, making just about any vehicle fit into that budget is possible.

The Payment Trap

The number one mistake when buying a vehicle is letting the dealership know your monthly budget. In terms of payments, almost any finance expert can make that monthly payment happen. And they do it by extending the term, or length of the loan.

Let’s use the following example to illustrate how this is possible.

Assume the car you want is $30,000. You’re approved rate is 3% APR.

Term Payment Interest

60 Months $539.06 $2,343.64

72 Months $455.81 $2,818.34

84 Months $396.40 $3,297.52

Notice how the monthly payment goes down with the longer term, but the total interest you pay increases. The difference in this example between a 60 month and 84 month payment is $142.66! While that is a big monthly savings, you’ll notice you also pay an extra $953.88 in interest over those extra 24 months.

It’s very easy to see how dealerships are able to use ‘funny numbers’ to get just about any price to fit your monthly payment. And because we’re excited about buying a new car, if the payment fits our monthly budget, we’re happy. It’s not until later that we realize our mistake in buying a vehicle we probably couldn’t afford.

Make Price the Focus

One of the easiest and most effective ways to prevent falling into the payment trap is to get a pre-approval before you go car shopping. A pre-approval means you applied for your vehicle loan at your financial institution, they reviewed your finances with you and approved you to borrow a specific amount.

This approved amount is the maximum you’re able to borrow and prevents a dealership from putting you into a vehicle you cannot truly afford. Instead of focusing on monthly payments, the focus becomes the total vehicle price; thus, eliminating the payment trap.

We’re Here to Help!

When you’re ready to begin looking for your next vehicle, stop by the Credit Union or give us a call at 410-687-5240. We’re ready to help you get pre-approved and lock in a great, low rate.

RETURN TO THE TOP

How to Avoid Common Dealership Tricks

When you visit a retail store, you find the product you want, add it to your basket, and make a purchase at a cashier. When you’re buying a new or used vehicle, you have a sales professional by your side to help you make the best decision. But, are they always helping you to buy the car that’s right for you or do they have a profit goal in mind instead? Most dealerships do a great job of helping car buyers find excellent vehicles that fit their budget. Yet, there are plenty of situations where this is just not the case.

You can protect yourself and ensure you invest in a quality vehicle at the right price. To do so, it helps to know some of the tricks dealerships use as well as a few tips for ensuring you’re satisfied with your investment.

#1: Get the Finances Straight First

Get pre-approved at the credit union before ever stepping foot onto the car lot. This way, you know how much you can affordably spend to buy a car. But, once you arrive, some dealerships will encourage you to let them help you find other financing options. Remember, sales professionals earn a profit on those loans. Instead:

-

Get pre-approved for a loan prior to arriving on a lot.

-

Know the amount and terms of your pre-approved loan.

-

If the dealership offers a better deal, look at all factors including how much you are borrowing, interest rate, the length of the loan, fees and possible limitations on refinancing.

#2: Don’t Feel Rushed into a Buying Decision

Spending $10,000, $20,000 or more on a vehicle is a big financial decision. You should never feel pressured to buy the first time you visit. Even if you love the vehicle, leave it there. Leave the lot and go home. Despite what the salesperson claims, chances are good the vehicle will still be there. In some cases, the dealership may give you a call the next day with a better offer.

Don’t buy if you’re rushed. And, if you do, and regret it the next day, take the vehicle back. Most states have laws in place to allow you to return the vehicle and get out of the loan within a few days of agreeing to it.

#3: What They Promise, Isn’t Always What Happens

Some car dealerships will promise a specific monthly payment or a specific interest rate. You find the vehicle you want and head into the financing office. Then, things change. Suddenly the vehicle is a few thousand dollars more or that monthly payment is actually $50 more than it was.

This is why you’ll want to be sure you have a loan arranged prior to your arrival. In doing so, you’ll be able to tell the dealership exactly what you’re approved to spend. They can help you to meet that goal or you can go elsewhere.

There’s plenty of competition in the auto sale market. Most of the time, there are a handful of vehicles around the same price point for the same vehicle in your area. By shopping around and being aware of the less-than-ideal sales tactics of some dealerships, you can make a better decision for you.

We’re Here to Help!

When you’re ready to begin looking for your next vehicle, stop by the Credit Union or give us a call at 410-687-5240. We’re ready to help you get pre-approved and lock in a great, low rate.

RETURN TO THE TOP

KNOW Before You GO [Car Shopping]

Purchasing a new or pre-owned vehicle is an exciting time, but it’s also a big financial move. So whether you’re buying your first car or you’re a self-proclaimed car-buying guru, we have a few tips everyone can appreciate.

Get Pre-Approved

When buying a new or pre-owned vehicle, you’re FIRST STEP (and most important) should be to get a pre-approval from the credit union. Not only will you know exactly how much you’re able to spend before you go shopping, you’ll also have the upper-hand when it comes to negotiating at dealerships.

Dealers know they cannot go over your pre-approved amount. This helps eliminate costly add-ons and often results in better sale prices as salespeople are forced to keep prices aligned with your pre-approved amount.

Do Your Research

Before you ever step foot into a dealership, do a little research. The Internet is a great place to start and provides a wealth of valuable information.

-

Research Invoice Prices (or what others are paying in the area for the same vehicle)

-

Review Sale Prices at Several Local Dealerships

-

Analyze Rebates & Special Promotions

-

Obtain Your Vehicle’s Trade In Value from NADAGuides.com

-

Pull a Car History Report (if purchasing a pre-owned vehicle)

Check Your Insurance

Buying a new vehicle is exciting. And with that excitement comes one of the most commonly overlooked aspects of buying a car – checking your insurance costs. New vehicles and some specific types of vehicles (i.e. convertibles) may have higher insurance costs. While you may be able to afford the monthly car payments, don’t get caught with unexpected, higher insurance costs. A quick call to your insurance company will let you know what your new insurance premium will be.

Types of Dealerships

Did you know there are different types of dealerships? Some dealerships focus on individual car sales where they try to get the most they can from each vehicle they sell. Other dealerships are volume

dealers. Their priority is to sell a certain number of vehicles during a set time period in exchange for incentives from auto makers.

The volume dealers will often offer higher discounts / incentives because they are trying to move as many vehicles as possible during a given month or set period. You will often hear these dealers advertising most vehicles sold and special month-end sales.

Ready to Start Shopping?

If you’re ready to buy a new vehicle, we’re ready to help. To get Pre-Approved, stop by the Credit Union or give us a call at 410-687-5240.

RETURN TO THE TOP

Quick Tips for Buying Pre-Owned Vehicles

Buying a new vehicle isn’t the only option. Today, it’s possible to save money and even make a better investment by purchasing a pre-owned vehicle. However, not every vehicle on the lot is a good buy. There are several steps vehicle shoppers need to take to ensure they are making the best financial decision possible for their needs. What should car buyers look for when buying pre-owned vehicles?

The History of the Vehicle

A good place to start is with the history of the vehicle. A Carfax report can provide this. Most dealerships will provide a link to the Carfax report. If not, users can visit the company’s website and search by the vehicle’s identification number. This is particularly important for anyone completing a purchase from an individual seller rather than a trusted dealership. The Carfax will provide detailed history of the vehicle’s maintenance, known repairs, and accident information.

Research Thoroughly

As your credit union, we will provide you with some insight into the value of the vehicle. Yet, with a bit of research online from sources such as Kelly Blue Book, you can have a good idea of what a vehicle is worth. Then, use any flaws you find, such as worn tires or damaged upholstery, to help you to negotiate the price lower.

Buying As-Is

If you are purchasing a vehicle from an individual, you have little resources should a problem occur down the road. In effect, you are buying the vehicle as-is. As a result, you’ll need to take every step you can to ensure the vehicle is safe and in good condition. If a problem arises later, it can be impossible or very difficult to hold the previous owner accountable.

A Full Inspection

To remedy the risk (or at least reduce it) all vehicles should have a full inspection by a mechanic or repair shop you trust prior to purchase. Don’t go with what the individual or even the dealership tells you. You can ask for your mechanic to have a look under the hood and to compile a thorough list of what may need to be repaired down the road. For the small fee your mechanic charges, it can be worthwhile to have peace of mind.

Guarantees, Warranties, and Promises

It’s also essential to read the fine print. No matter who you buy from – an individual or a dealership, you need to know what the promise is as well as what your recourse is. For example, some dealerships provide warranties on pre-owned, certified vehicles. What does that include? More specifically, what doesn’t it include? For any guarantee, read the details about what is guaranteed and for how long. This differs from one location to the next and can directly impact your recourse.

We’re Here to Help!

It’s essential to know what you are buying and who you are buying from, but when you do this, you can find a fantastic vehicle that’s cost effective. Pre-owned vehicles can be a great investment simply because they are much more affordable overall compared to a new vehicle. New vehicles tend to depreciate at a faster rate as well.

When you’re ready to begin looking for your next pre-owned vehicle, stop by the Credit Union or give us a call at 410-687-5240. We’re ready to help you get pre-approved and lock in a great, low rate.

RETURN TO THE TOP

6 Car-Buying Mistakes to Avoid

Consumers tend to have negative feelings toward dealerships. While some dealers might earn these reputations, most are not shady or dishonest. What drives this mindset is that you can negotiate car prices, which leaves car buyers wondering if they really got a good deal.

But many members are surprised to learn that you don’t need to be a top negotiator to drive away happy. Most of the effort, and mistakes, happen well before you ever set foot in a dealership. Review the following six car-buying mistakes and how to avoid them as you search for your next vehicle.

#1: Failing to Secure Financing Ahead of Time

Blindly walking into a dealership finance office is a big mistake. It’s not every day that you buy a car, and that payment will impact your budget for several years. Without approved financing, you’re at the mercy of the dealership – which could result in higher interest rates or unfavorable terms.

How to Avoid It: Before visiting a dealership, stop by the credit union to become pre-approved. A pre-approval is a financial document that states how much you’re approved to borrow for your new car. It’s one of the best moves you can make before buying a car for several reasons:

-

It lets you know exactly how much you can afford to spend.

-

It helps prevent dealerships from selling you expensive add-on products.

-

It gives you the upper hand in price negotiations.

-

It allows you to avoid dealership pricing games and gimmicks.

-

It locks in your interest rate before you shop.

#2: Focusing Too Much on Monthly Payments

When looking for a new car, the first question people usually ask themselves is, “What can I afford to spend each month?” Likewise, this is typically the first question a car salesperson will ask you.

Why is this a mistake? Because with a bit of funny math, it’s easy to manipulate the monthly payment. By extending the loan term, you could end up in a car you cannot afford – even though the payments are nearly identical.

Example:

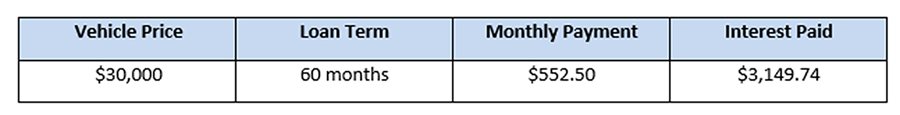

Assume you’re pre-approved to buy a $30,000 vehicle at 4% APR with a loan term of 60 months. In the example below, you can see your monthly payment is $552.50.

Now review what happens when the loan term is extended. Dealers can sell you a higher-priced vehicle yet keep the monthly payment almost the same. You’ll also notice the amount you pay in interest increases significantly even though the interest rate remained unchanged at 4% APR.

Without realizing it, you might get stuck with a car you cannot actually afford. Or worse, since cars depreciate quickly, you could end up owing more than the vehicle is worth.

How to Avoid It: By getting pre-approved in Step #1, you’ll already know how much you can afford to spend, along with your estimated monthly payments. So, when negotiating, you can avoid focusing on monthly payments. Instead, your goal is to keep the total car price below your pre-approved amount (in this example, $30,000).

#3: Not Knowing the Value of Your Trade-In

Trading in a vehicle is a significant financial benefit because it acts as a down payment on your new car. If you’re unsure what your trade-in is worth, you could lose a substantial amount of money in the deal.

How to Avoid It: Luckily, it’s pretty easy today to estimate the value of your trade-in. Kelley Blue Book (www.kbb.com) is a popular website that allows you to obtain the value of your current car. Another option is to visit local dealerships and ask them to appraise your vehicle. Once you know your trade-in’s worth, you can avoid being undercut by dealerships.

#4: Shopping Only Local Dealerships

Shopping at local dealerships is convenient. If your schedule is busy, you can stop by your local car dealer on the way home from work. However, not all dealerships are the same. Some will carry a wider variety of inventory. Others might be interested more in your trade-in to resell. You must thoroughly research your options to ensure you get a stellar deal.

How to Avoid It: The internet makes researching vehicles a breeze today. Start local, then expand your search to include dealerships that are 10, 20, or even 50 miles away. It might be a bit of a drive, but it could be well worth it if you save hundreds, or even thousands, of dollars.

#5: Forgetting to Call Your Car Insurance Company

Purchasing a new vehicle is exciting and it’s easy to get caught up in the moment. Before you know it, you’re driving away in a brand-new car. A common issue car buyers face after the sale is a significant jump in their car insurance – which could strain your budget for years to come.

How to Avoid It: Your monthly car expense includes more than the loan payment. You’ll also want to factor in car insurance, maintenance costs, and fuel.

Before agreeing to purchase a car, contact your insurance company to obtain updated quotes. If you want a specific vehicle, provide the Vehicle Identification Number (VIN) to your insurance provider. They’ll typically be able to give you an exact policy cost within minutes.

#6: Going to Just “Look Around”

When you step onto a dealer’s lot, you must be prepared to do one of two things: buy a new car or walk away. Too often, people who want to “look around” end up as new car owners. Salespeople make their livelihood by selling cars. Consequently, they will try their hardest to sell you a vehicle that day – whether you’re fully prepared mentally (or financially).

How to Avoid It: Take a friend along if you want to look at vehicles or test drive one. Recruit someone that isn’t involved in the car-buying decision. Assign them the role of making you leave the dealership after you’ve had a chance to look around – without a new vehicle. Even if you find a car you love, leave the dealership, and think about it for a day or two. Ensure it fits into your budget and is the right vehicle for you and your family.

We’re Here to Help!

While buying a new car is exciting, it’s also a significant financial decision. Before you get too deep into the car-buying process, it’s wise to obtain a pre-approval. You’ll know how much you can afford to spend, and it can protect you from costly add-ons and dealership games.

If you’re interested in becoming pre-approved for your next car, please stop by the Credit Union or call 410-687-5240 to get started today.

RETURN TO THE TOP