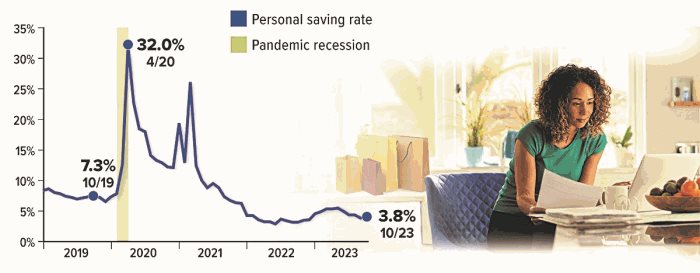

The U.S. personal saving rate — the percentage of personal income that remains after taxes and spending — was 3.8% in October 2023. The saving rate spiked to an all-time high during the pandemic, when consumers received government stimulus money with little opportunity to spend, but fell quickly as stimulus payments ended and high inflation ate into disposable income. The current level is well below pre-pandemic saving rates.

A low personal saving rate means there is less money available on a monthly basis for saving and investment. However, many households still have pandemic-era savings, and the low rate indicates consumers are willing to spend, which is good for the economy. The question is how long this spending can be sustained.

Need to improve your savings habits? Consider setting up a payroll deduction through your employer to deposit to your LM Federal Credit Union account. Any employer offering direct deposit will also support a separate fixed amount payroll deduction to the Credit Union or another financial institution.