Refinancing your car loan might sound like a mystical and complicated process, but that’s rarely the case. In truth, refinancing is one of the quickest and easiest ways to put more of your hard-earned dollars back into your wallet each month.

Believing common misconceptions about refinancing might be preventing you from pursuing one of the best financial decisions you can make for your budget. We’re here to debunk these common myths and help you gain a clearer understanding of how this process can instantly improve your finances.

Understanding Auto Loan Refinancing

Refinancing your car loan is essentially the process of replacing your current auto loan with a new one. Borrowers typically pursue a refinance to make their loan more favorable or affordable, either through better terms or lower interest rates.

For example, let's say your current auto loan is financed with a dealer and has an interest rate of 6.50% APR. The credit union might be able to lower your rate to 4.50% APR. While a 2% APR drop might not seem like a big deal, it can significantly reduce your monthly payment, and the total interest paid on your loan.

The best part about refinancing your car loan is the flexibility it offers. Here are some additional reasons you might consider refinancing:

-

Your credit score has improved since you initially financed your car – qualifying you for better rates.

-

You want to extend your loan term – leading to lower monthly payments & instant savings.

-

You want to shorten your loan term – allowing you to pay off the loan quicker & reduce interest costs.

Myth 1: It’s Too Much of a Hassle

Many drivers believe the misconception that refinancing your auto loan is a long and complicated process. We’ve made the application process easy, so instead of tedious paperwork, you can focus on how much you’ll save.

The application only takes a few minutes to complete, and you can start it online at lmfcu.org, over the phone, or at our office. Whichever avenue works best for you, we’re here to walk you through every step of the process. Here are the things you’ll need to get started:

-

Valid identification, such as your driver’s license

-

Personal information, including legal name, birth date, contact information, and Social Security Number

-

Proof of income, such as a pay stub or tax return

-

Proof of car insurance and vehicle registration

-

Current vehicle information, including year, make, model, mileage, and VIN

-

Current loan details, including the remaining balance, loan term, and lender billing statement

Our lending team will review your application once you submit it. When approved, we will send you the details for your new loan, including your new interest rate, monthly payment amount, and loan term.

Myth 2: The Process & Fees are Too Expensive

Some financial institutions may charge excessive fees for refinancing. However, credit unions, being not-for-profit and member-focused, typically keep costs low to maximize savings for members. Refinancing fees, if there are any, may include a small application or processing fee to cover the cost of filing paperwork.

Generally, auto loan refinances are all about saving you money. So, putting more money back in your pocket is the focus – not charging costly fees that will dampen your savings.

Myth 3: It Won't Save Me Much Money

The amount you could save by refinancing depends on your current loan details, how many payments you have left, and the new interest rate you secure. Many borrowers may see immediate savings by getting a much lower interest rate that drops their monthly payment significantly. Even if refinancing your loan doesn’t save you a ton of extra money right away, you can enjoy exceptional savings over the life of the loan.

Example:

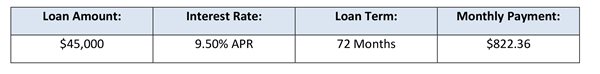

Assume you have a car loan that you originally financed with a dealership two years ago with the following details:

After two years, your current balance will be $32,733.22.

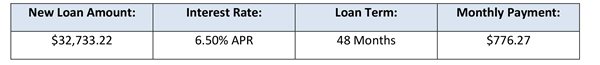

Now, assume you decide to refinance that loan with the credit union and lock in a lower loan rate at 6.50% APR.

Instantly, your monthly loan payment will drop by $46.09. But the best news is that you’ll save an additional $2,212.53 in interest over the life of your new loan! That’s over $2,000 back into your pocket to spend however you wish – just for refinancing your loan.

Myth 4: It'll Harm My Credit

As with any new loan, an auto loan refinance may temporarily ding your score by a few points. But this is completely normal and nothing to worry about. Since refinancing is essentially replacing your current loan with a new one for roughly the same amount, it usually has a very minimal impact on your credit score.

The initial drop typically occurs during the application process, which involves a credit check. Consequently, you’ll receive a hard inquiry into your credit report.

-

A hard inquiry is performed by all lenders when you apply for any new credit card or loan. The lender needs to review your current credit report before approving your refinance. The dip in your score should only be temporary.

-

A soft inquiry has no impact on your credit score. It is usually performed for non-credit-related scenarios, such as background checks, pre-qualifications, and when you check your own credit score.

Myth 5: Only People with Great Credit Can Refinance

This statement is one of the biggest fallacies of them all! While it’s true that individuals with excellent credit might have an easier road to refinancing, the process benefits those with less-than-perfect credit the most.

Dealerships and subprime lenders often lock car buyers with mid-to-lower credit scores into outrageous loan rates. These interest rates frequently exceed 18% APR and can leave drivers with astronomical monthly car payments.

Borrowers facing high rates on their car loans generally experience the greatest savings opportunities when refinancing. You have nothing to lose in applying – and potentially so much to gain!

Myth 6: Refinancing with a Credit Union Isn’t Any Better Than a Bank

While it may seem like refinancing through a bank or a credit union yields the same results, credit unions often provide distinct advantages that set them apart. Some of these benefits include:

-

Lower Rates: Loan rates at credit unions tend to be much lower than those at large banks or other major lenders. That’s because credit unions are not-for-profit financial institutions, so we return our earnings to members. One of the ways we do this is by providing lower loan rates to help you save more.

-

Fewer Fees: Another way credit unions share their profits with members (instead of shareholders) is by charging fewer and lower fees. This tactic is another way we live out the credit union philosophy of “people helping people” and help members keep more of their hard-earned money.

-

Special Offers: If you refinance while we’re offering a special promotion, you could luck out with even bigger savings! For example, you may snag an exceptionally low limited-time rate to boost your savings even more, or lock in no payments for 60 days. That’s two months of car payments instantly back into your pocket!

We’re Here to Help!

While the process of refinancing might sound intimidating, it’s quite simple. As a borrower, you have so much to potentially gain, especially if your credit score is less-than-perfect. Take time to gather your current loan paperwork and other required materials, and let’s work together to see how much we can help you save.

If you’re ready to put more money back in your pocket by refinancing your car loan or have questions about the process, we’re ready to help. Please stop by our office or call 800-410-0501 to speak with a loan specialist today.